Hollard Investment Philosophy & Process

Uncover the philosophy followed by our investments team

Hollard Investment Philosophy

The Hollard Investment Philosophy is to compound incremental outperformance over time and to do so by taking less risk than the market. We believe that by controlling the volatility within our solutions, we can smooth returns and provide clients with more consistent outcomes. Our investment philosophy is to avoid unnecessary volatility in delivering our solutions and that helps us avoid what we term the "volatility tax" - the underperformance investors experience in the presence of excess volatility.

Consistency is key

Consistency isn’t exciting. It’s essential. It is the day-to-day slog that, over time, allows investments to compound and grow. Often when funds are compared, they are done so on a return’s basis.

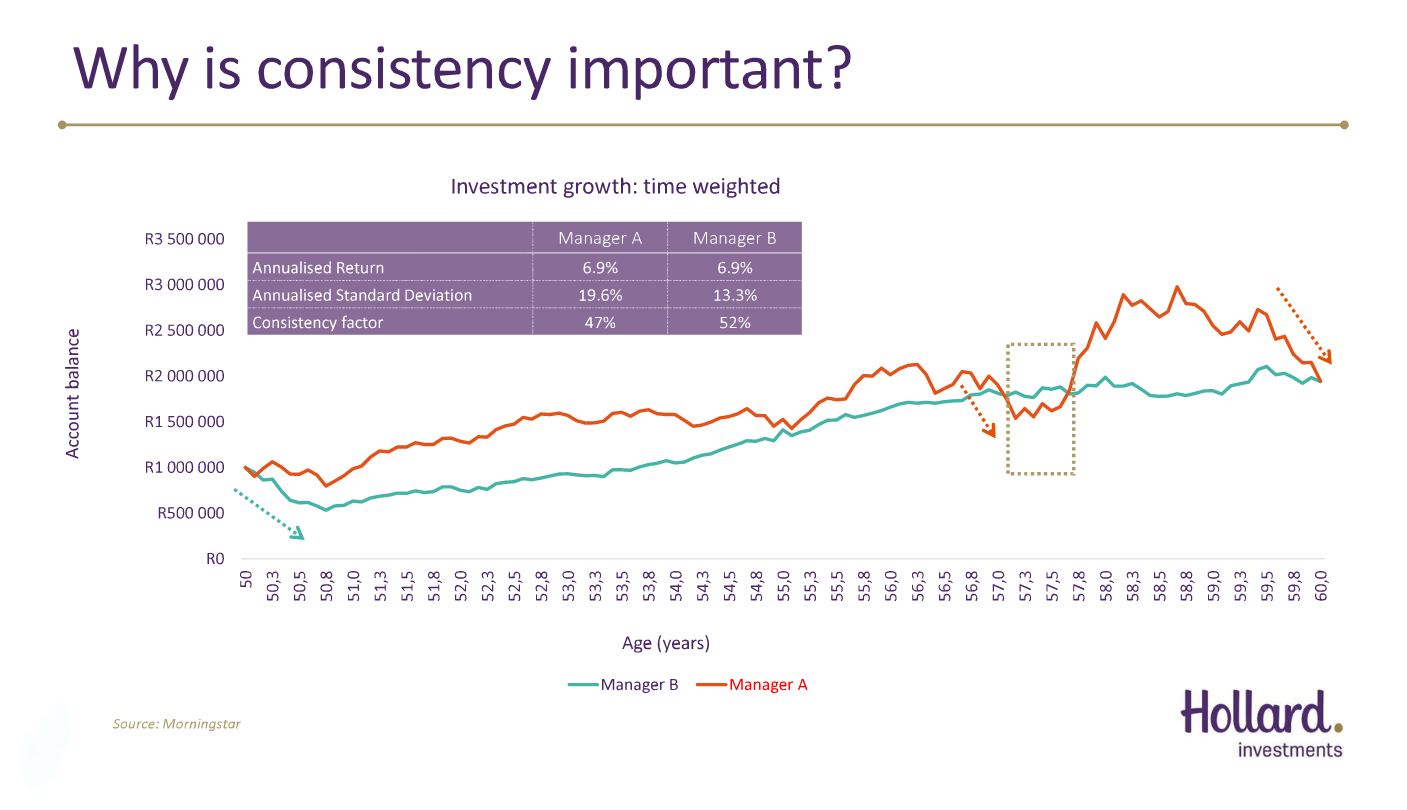

However, not all returns are created equal. In the illustration below, we have compared two funds that both delivered 6,9% per annum (measured over a 10-year period). However, manager A’s fund was more volatile than manager B's (manager A’s annualised standard deviation was higher than manager B’s). If you invested a lump sum of R 1 million, as illustrated below, you would have ended up with the same investment amount at the end of 10 years. However, the journey would have been substantially different.

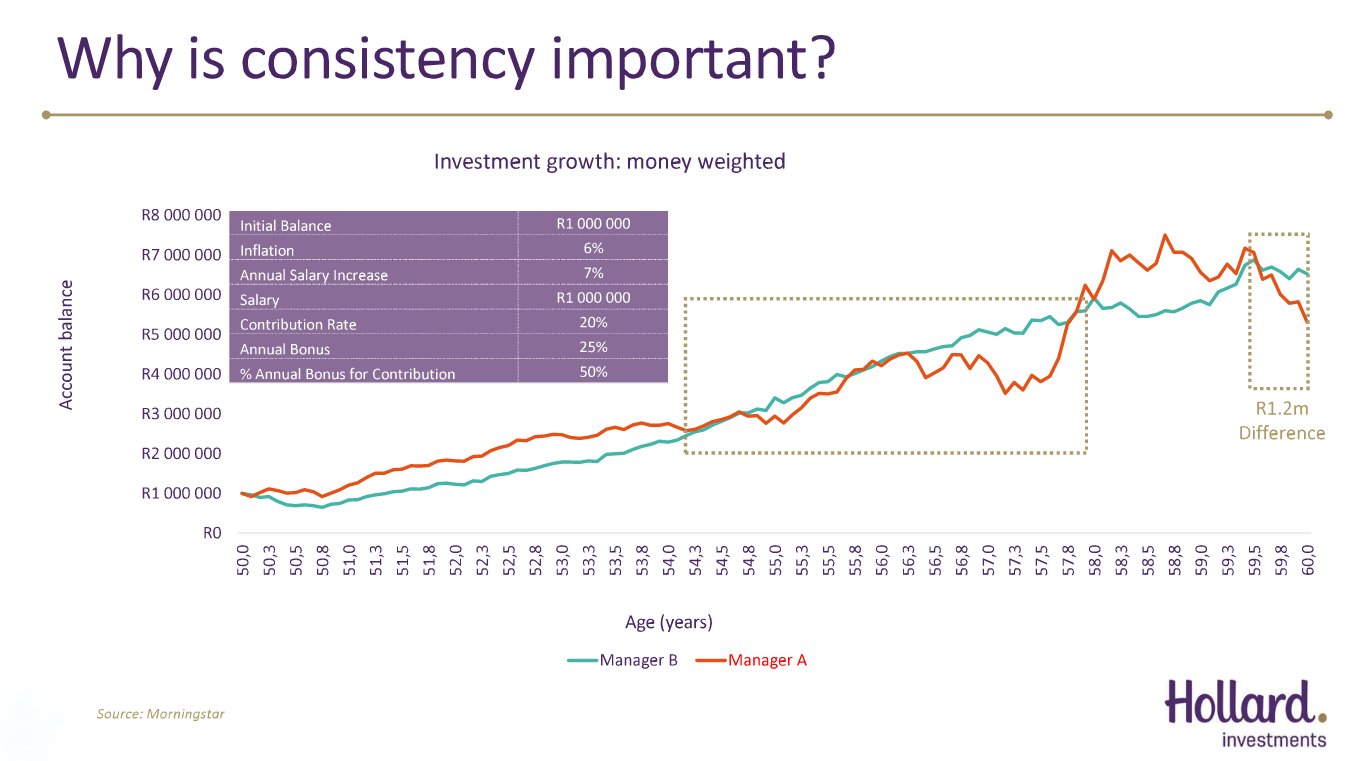

However, if you invest a lump sum, with a monthly debit order, and invest ad-hoc additional contributions, the picture looks vastly different. The graph above illustrates a client that also made a R1 million lump sum investment. However, they also contribute a monthly amount (20% of salary, which increases 7% every year). The client makes an additional contribution annually (50% of their bonus, which is 25% of their salary). The impact of the difference in volatility of the two funds amounts to R1.2 million.

The Hollard Investment Process

The Hollard investment process gives expression to the investment philosophy. The process ensures continuity in the delivery of a promised outcome, giving investors the comfort of knowing that the outcome being generated will continue to be delivered day in, day out, over the long term.

Need to get in touch with us?

Call Hollard Investments on

0860 202 202 or email

customercare@hollardinvestments.co.za

Visit our secure online portal to open your own unit trust or manage existing investments.

Have a complaint?

More about the Hollard Prime Unit Trust Funds

How to invest with Hollard

The Hollard Prime Unit Trust Funds can be accessed via the following Hollard products:

Flexible Savings

Achieve all your financial goals with our simple and flexible savings plan solutions.

Retirement Savings

Achieve financial independence in your retirement years by investing in one of our retirement policies.

Tax Efficient Savings

Reach your savings goals using a tax-efficient endowment that also provides estate planning benefits.

We recommend you consult a qualified financial adviser to adeptly guide you in choosing suitable products and portfolios for your unique financial needs. If you’re confident in your choices, you can invest directly with Hollard.

Ready to invest without the assistance of an adviser? Get an online quotation now.

Find everything you need to invest with us now or manage your existing investments.

Why invest with

Hollard Investments?

Hollard Investments is a subsidiary of the privately-owned Hollard group. Working together while enabling clients to create and secure better futures is at the core of Hollard Investments’ purpose. We strive for a more efficient and accessible way for your money to get you to where you want to be. Hollard Investment Company is committed to shared success with financial advisers and investors. We’ve got this, together.

Have some questions or looking for further insight?

Send us your details and we will give you a call.

Prime has been appointed as the registered management company of the Hollard Prime Unit Trust Funds.

Visit the Prime Group for more information.

Disclaimer

The Hollard Prime co-named funds (as defined in BN 778 of 2011) are registered under the Prime Collective Investment Scheme, managed by Prime Collective Investment Schemes Management Company (RF) (Pty) Ltd (“Prime CIS”) (Registration No. 2005/017098/07), a registered Collective Investment Schemes Management Company in terms of the Collective Investment Schemes Control Act 45 of 2002, supervised by the Financial Sector Conduct Authority (‘FSCA’). Hollard Investment Managers (Pty) Ltd is the FSCA-approved and appointed investment manager of the co-named CIS funds.