Writer, strategist and runner, Lisa James* appeared to have it all. A go-getting mother of two, in her mid-40s, she prided herself on her healthy lifestyle and, on top of a carefully planned mix of life insurance, income protection and investments, she had a decent rainy-day nest egg. So hitting rock bottom was the last thing she expected.

It wasn’t an awful maiming accident or a terminal condition that turned her personal, professional and financial life upside down. It was a stress-induced diagnosis of benign multiple sclerosis, a chronic condition in which the immune system attacks the central nervous system.

“My doctor booked me off for six months to recover and, while the diagnosis devastated me,” says Lisa, “I had an income protection policy to cover me during that time, which cushioned the blow initially. However, my physical and mental recovery was slower than expected: six months turned into two years, and wiped out my nest egg in the process.”

Serious disability insurance shortfall

Lisa’s story is not an uncommon one. While the average middle-income South African has around R900 000 in income protection, the Association for Savings & Investment South Africa (ASISA) recently conducted a study into the impact of disability on financial security. It concluded that at least R2 million insurance cover would be necessary to ensure the same standard of living could be maintained if the policyholder became disabled and unable to work.

ASISA assesses that South Africans are seriously underestimating the impact disability can have on their family's financial security and – with the shortfall typically exceeding R1-million – they face the uncomfortable choice between biting the bullet and increasing monthly payments now, or risking a drastic cut in living expenses if their main breadwinner should ever suffer a disability.

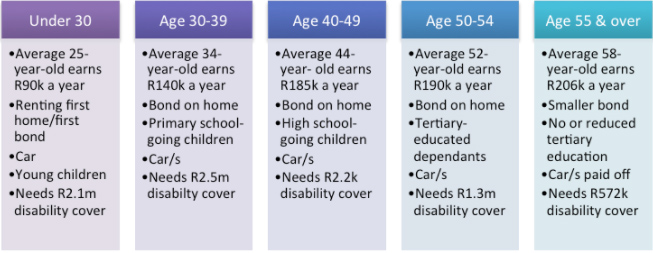

Of course, the level of cover depends on an individual’s income and, as this table shows, it varies at every age and stage of life. However, the reality – according to The South African Insurance Gap 2016 research report, conducted by True South Actuaries & Consultants on ASISA’s behalf – is that South Africans are underinsured for permanent and temporary disability by as much as 59%. (This is up 6.3% on the previous report, which was conducted in 2013.)

(Source: The South African Insurance Gap 2016, ASISA)

Why do your clients shy away from disability insurance?

There are several reasons why disability products are less popular than other kinds of life insurance. According to Hollard Life’s Head of Product & Technical, Ryan Chegwidden, the main one is that it’s regarded as a fringe risk and, “for some reason, it’s easier for people to wrap their heads around the need for life cover, which takes care of their loved ones if they die and aren’t around. So, when it comes to finding a balance between affordability and insurance needs, they tend to choose a product that deals with the inevitability of death rather than the likelihood of disability.”

However, although the concept of living through a serious illness or an accident that may leave them disabled and unable to earn an income – even temporarily – is something few people consider, ASISA’s statistics are emphatic. According to its report, South Africans experience a total of 46,400 disabling events each year or, put another way, 127 disabilities every day.

“After what happened to me, I now realise it can happen to anyone,” says Lisa, “and I was someone who thought I had it all covered. ‘Benign’ MS is a serious oxymoron! Your doctor tells you that you have some disease, but that it won’t get worse, and then you realise it has hit you where it truly hurts – in your ability to get out and find work, your ego, your confidence and, worst of all, your rapidly depleting bank balance.

“I’m just another statistic in a situation that, I’ve discovered, goes across all income brackets. I wasn’t in a wheelchair, I didn’t have cancer or a terminal disease, but there were many, many dreadful days that my seemingly invisible disability left me completely debilitated and unable to get out of bed, let alone work. There was simply no predicting what kind of day ‘tomorrow’ would be for me. It was scary, and I was worried sick about where my next paycheck would come from and how my family would cope.”

Disability comes in many forms

“Many people incorrectly assume that the most common causes of disability are freak accidents and injuries, which leads them to believe the odds of suffering a disability are much lower. But that’s a myth,” says Ryan.

”While it’s true that musculoskeletal and joint disorders are the leading causes of disability, most are shocked to find out that illnesses such as cancer, cardiovascular disease, and gastrointestinal and neurological disorders also top the causes that prevent people from being able to work and earn an income again, and which we’re seeing more commonly in younger people, too.”

Although Hollard Life’s concern is to educate people about the function and benefits of disability insurance, Ryan is quick to caution against creating further financial pressure to close the insurance gap: “When it comes to getting the right type and amount of cover, timing is everything, and it’s best to talk to your clients about putting a plan in place to close the gap year-on-year, as circumstances and budgets allow.”

*Lisa James’ account of her struggle is factual. However, we have changed her name in the interests of her privacy.

Are you following us on Twitter and LinkedIn for real-time updates?